AI for Everyone

Empowering Community and Mid-Sized Banks

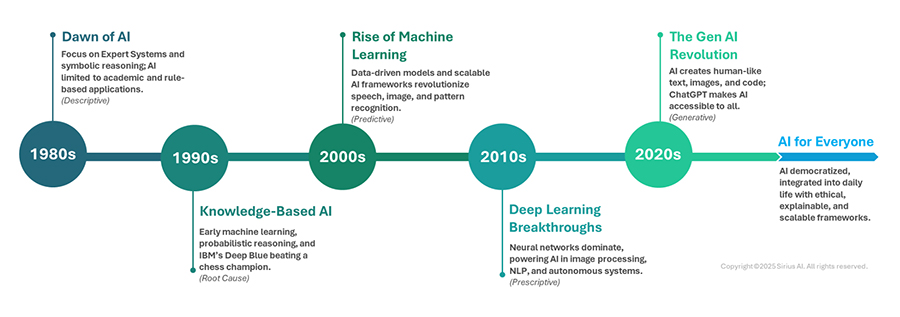

Introduction to The Rise of AI

Over the past two decades, analytics and machine learning (ML) have been integral to the financial services industry, enhancing areas such as marketing, credit underwriting, fraud detection, customer retention, process automation, and pricing. These technologies have consistently delivered value by improving efficiency and precision. Now, with the advent of Generative AI, a new era of transformation is emerging, offering tailored solutions that align with the specific needs and capabilities of community and mid-sized banks.

Since ChatGPT's release in 2022, Generative AI has become more accessible. For smaller banks, this means they can finally tap into previously unreachable workflows and achieve major efficiency gains.

Late in 2022, Generative AI captured global attention with the release of ChatGPT. While large language models (LLMs) had been in development for years, their capabilities became accessible to a broader audience with this milestone, reshaping how organizations approach AI. For community and mid-sized banks, this wave of innovation presents an opportunity to unlock capabilities beyond traditional AI’s reach. These banks, often operating with constrained resources and smaller IT teams, can now leverage Generative AI to tackle specific workflows, automate processes, and enhance customer interactions without the need for extensive in-house expertise.

By Sirius AI’s estimates, Generative AI will impact 70% of use cases in financial services over the next two years, enabling community banks to gain a competitive edge. Approximately 20% of these use cases focus on previously unaddressed workflows, solving challenges that Core AI could not address due to technical or ROI constraints.

For example, a mid-sized bank leveraged an AI-powered customer correspondence solution to automate over 15,000 monthly customer requests, significantly reducing the workload of over 60 employees. By automating 40–50% of repetitive tasks, the institution achieved cost savings of $400K–$600K annually and improved response times by 30–40%. This implementation not only enhanced customer satisfaction but also enabled the bank to scale operations efficiently without requiring additional resources.

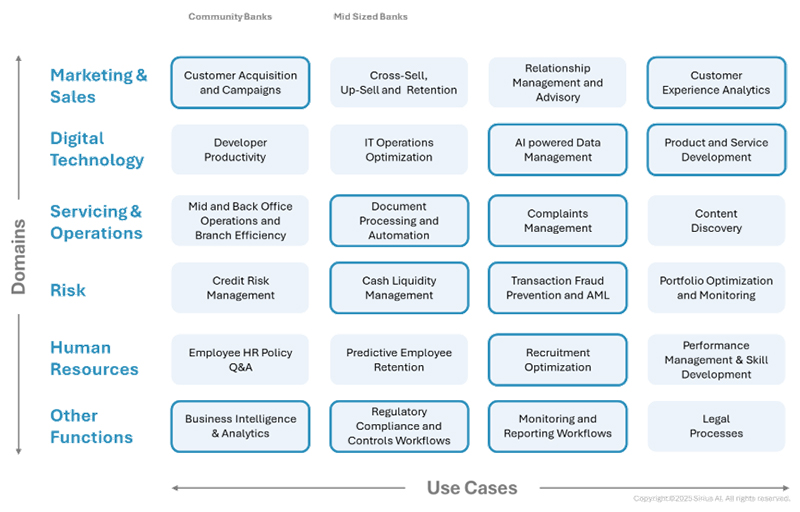

Transforming Functions – Where AI is Being Deployed in Banking

Generative AI is reshaping operations for community and mid-sized banks by addressing specific, high-impact workflows. These solutions redefine how tasks are executed and insights are consumed, providing tailored functionality to meet the unique needs of smaller institutions.

For instance, front office employees can leverage dynamically generated insights to better understand and address customer needs. Imagine a branch officer assisting a customer with loan inquiries: instead of sifting through multiple systems, AI presents relevant insights and recommendations in an intuitive, conversational format. This enables faster, more accurate decisions and a highly personalized customer experience, strengthening trust and loyalty.

Data and technology teams also see significant efficiency gains. Some banks are now deploying automated machine learning engines powered by Generative AI, allowing them to create and execute marketing and sales campaigns in a matter of weeks rather than months. These systems use AI-driven customer segmentation and targeting to improve campaign precision, leading to better conversion rates and reduced marketing costs. Even banks without in-house AI teams are adopting such solutions through AI-as-a-service platforms, enabling them to scale capabilities without the need for deep technical expertise.

By integrating AI-driven automation, community and mid-sized banks can reduce operational burdens, improve decision-making, and enhance customer engagement—bringing sophisticated AI capabilities within reach without requiring extensive internal resources.

Infographic: Generative AI is being deployed across a wide range of functions within financial institutions, from risk management and customer service to operations and marketing.

Making AI Actionable: How to get Started?

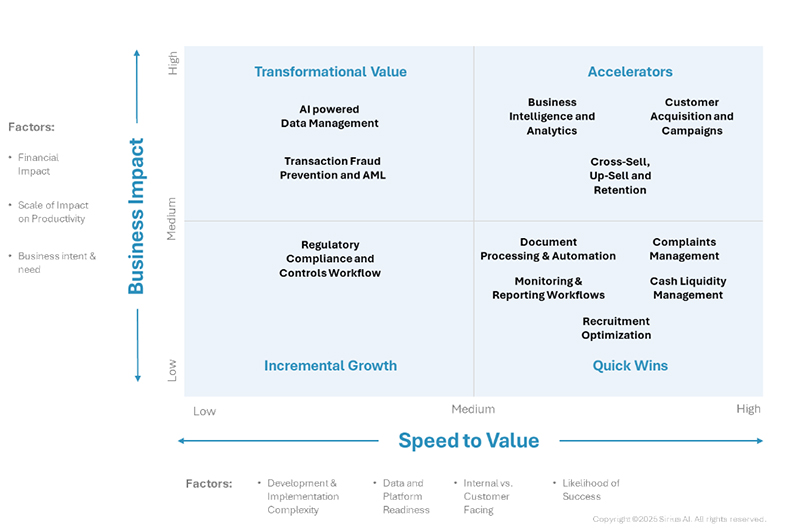

Success with AI begins with identifying and prioritizing use cases based on two key factors: Business Impact and Speed to Value.

In our experience, some of the most impactful use cases end up being Accelerators or Quick wins but the priority is very specific for every Community and Mid-sized Bank.

Evaluation Framework recommended by Sirius AI

Four most important learnings from effective AI implementations seen by Sirius AI

Align AI Initiatives with Strategic Goals : AI adoption should start with a clear alignment to the bank’s broader objectives, whether it’s improving customer acquisition, enhancing risk management, or streamlining operations. Banks should begin by brainstorming and prioritizing AI use cases that address pressing challenges and deliver measurable value. Misaligned implementations often become isolated experiments with limited traction, resulting in wasted resources and minimal business impact.

Start with AI Pilot Projects : Implementing AI does not have to be an all-or-nothing approach. Banks should begin with small-scale pilots to test AI-driven solutions in controlled environments, measure impact, and fine-tune implementations before expanding across functions. This approach allows for quick learning, risk mitigation, and early wins that can justify further investment. Successful pilot projects also help build internal buy-in and confidence in AI-driven strategies.

Leverage External Partnerships : Building AI capabilities from scratch can be resource-intensive and time-consuming. Community and mid-sized banks can accelerate adoption by collaborating with AI vendors, fintech companies, or AI consultants that bring specialized expertise and pre-built accelerators. These partnerships allow banks to access state-of-the-art AI without the need for large in-house teams, ensuring faster deployment and better return on investment.

Focus on Cost-Effective Solutions : Given budget constraints, banks should opt for modular and scalable AI solutions that offer flexibility without excessive upfront costs. Cloud-based AI platforms, AI-as-a-service models, and API-driven AI solutions enable banks to adopt AI incrementally, scaling as they see success. The focus should be on solutions that balance functionality, affordability, and long-term sustainability to maximize returns.

By adopting a thoughtful and strategic approach to AI, community and mid-sized banks can enhance their operations, offer improved services to customers, and remain competitive in the evolving AI and financial landscape.

About SiriusAI

SiriusAI provides financial institutions, payments companies, and Fintechs with AI Consulting and development of measurable outcomes with AI Solutions. SiriusAI is proud to serve multiple banks, fintechs, and other institutions across Georgia.

Learn more at www.siriusai.com